Managing your money can sometimes feel like quite a strenuous task, especially for those who are self employed. In an ideal world you’d have a high end accountant dealing with all the finances of your business but if you can’t afford such a luxury then you may be tempted to work out your costs and expenditure yourself. Doing this, although not always an issue, can lead to problems down the line and even leave you out of pocket if you miss things out or do things wrong. Here we take a look at some of the ways you can fall prey to accounting mishaps, and give you tips on how to avoid them.

Keeping Track Of Tax And VAT

You’ll likely have heard many horror stories about people neglecting their duties and ending up with a tax bill the size of their arm. Some taxes are fairly straight forward such as PAYE and income tax. It’s when you get into more involved industries where tax can be a nightmare. For instance, if you use certain machinery or run a lottery based business you will need to pay what it known as Excise Tax. VAT should be an important consideration too not only in terms of paying it, but also in terms of claiming it. Many businesses can get back most of the VAT they pay for things like office goods and travel costs, but you will still need to check what is and isn’t allowable before filling out your tax return. Missing the deadline on your return could leave you with a fine of up to £1,500 if you’re more than six months late.

So recently I was getting this ‘DNS Probe Finished No Internet’ error while trying to browse the internet which was very frustrating. Are you also fed up of having “DNS_PROBE_FINISHED_NO_INTERNET” error in Google Chrome browser? dns_probe_finished_no_internet

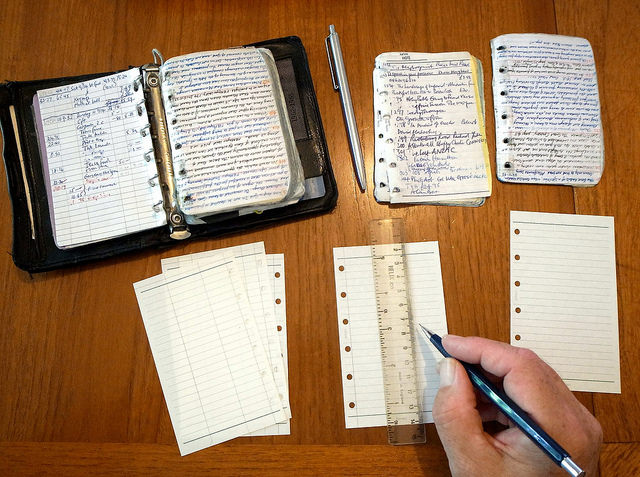

Filing All Company Receipts

It sounds so obvious but keeping a hold of all receipts that relate directly to the business is essential for working out budgets for the future and sorting out your cash flow for the months to come. In the first instance you need it as proof for claiming back VAT otherwise you’ll needlessly be paying more money than necessary, but it can also be an indication of overspending, or indeed under spending. It can help you to spot patterns in your spending as well as the costs for certain services year on year, plus faulty or damaged goods need the appropriate receipt in order to claim for a replacement or a refund. It can definitely be a life saver if you suspect your bank account has been hacked or if you still have warranty on electrical goods. No one wants to be stuck with a useless product and an empty wallet.

Tracking Direct Debits And Debts

These are some of the more critical payments your company will be responsible for, and they need to be closely monitored on a regular basis. You may have a number of direct debits for things like utilities and paying off expensive goods and if a payment fails without you noticing you could be charged extra for failing to provide. You might also have a direct debit set up for your website’s hosting, which could have disastrous consequences if not paid including the site going down and the possibility of loosing the site completely. Debts should be kept on close watch too as this can lead to various cash flow problems. Clients refusing to pay up must be chased, and any outstanding invoices you have yourself should be paid as soon as possible to avoid late charges.

Figuring Out The Figures

Let’s face it, not everyone is as savvy with numbers than they might lead themselves to believe. Accounting for an entire business is by no means an easy feat which is why it’s normally left to the professionals to deal with. The trouble with crunching all the numbers yourself is that you may make subtle mistakes that get overlooked such as writing the wrong figures or making the wrong calculation. You have to check, recheck and check again to make absolute sure there aren’t errors and even then you may still have turned a blind eye. Accountants are specifically trained to spot these errors before they become an issue, and can alert you to potential problems before they happen. If you’re thinking about doing the accounts yourself it’s advised you still get an expert to look over your workings. It could save you a handsome sum.