As part of the mini budget announced at the start of July by Chancellor Rishi Sunak, a stamp duty holiday is being enacted as part of the economic recovery plan. This temporary tax reprieve/reduction applies in England and Northern Ireland and will hopefully act to stimulate the property market at a time when people may have reservations about making large-scale financial decisions.

In the first quarter of 2020 the average house price decreased monthly, with the number of property transactions conducted drastically falling too. It is hoped that the stamp duty holiday will offer assistance to people who have been negatively affected financially by the pandemic whilst encouraging house prices to stabilise by the renewed interest in the market.

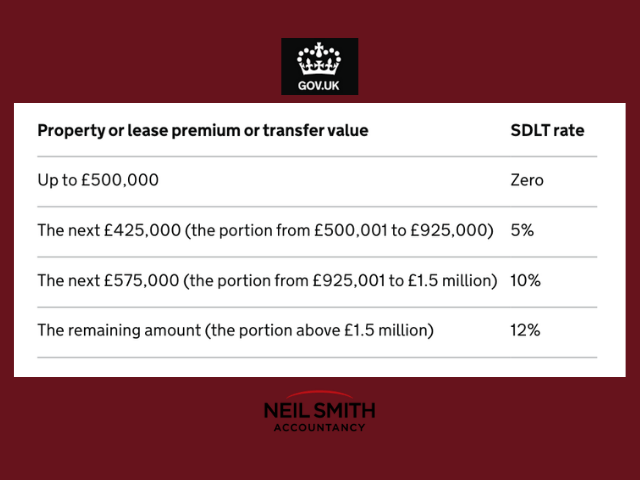

Property sales completing before 31st March 2021 can benefit from the new rates, lifting the lower threshold to £500,000 from £125,000. It is estimated that 90% of purchases will fall into the lower bracket, thus avoiding paying stamp duty entirely. This also spells good news for first-time buyers who were previously exempt from stamp duty up to £300,000 but expected to pay at a rate of 5% between £300,001-£500,000.

The 2% stamp duty tax bracket has been temporarily removed since its values now straddle the 0% and 5% pay rates. The highest value brackets will continue with the usual rates; £925,001-£1.5m is 10% and purchases above £1.5m pay 12%. The tax rate will only be applied to the value over £500,000.

If the buyer is obtaining a second home they would still benefit from the stamp duty changes but would be expected to pay a 3% surcharge on the purchase price. Residential purchases made by ‘non-natural persons’ – this term covers companies, partnerships that include companies and collective investment schemes – will continue to be charged 15% over £500,000.

The latest HMRC figures state that stamp duty raises around £12bn annually, making up roughly 2% of the total Treasury income. The Stamp Duty holiday is expected to cost the Treasury £3.8bn across the nine months that it will be active. On the 1st April 2021 the tax brackets will revert back to normal.

These changes are effective immediately and are applicable during the purchase of a main place of residence in England or Northern Ireland. Where purchasers in Scotland and Wales are exempt from stamp duty, they do have to pay an alternative tax. In Scotland, the Land and Buildings Transaction Tax will be waived on purchases up to £250,000 (an increase from £145,000) and in Wales, the Land Transaction Tax lower threshold will also rise to £250,000 (increasing from £180,000). These will both be continuing until the 31st March 2021.

Neil Smith Accountancy provides expert business start up advice, so if you’re taking the plunge with a new business yourself during these trying times, get in touch for a free consultation to see how we can help. If you already have an established small company, we can help with your accounts and bookkeeping and offer practical advice for your business. Call the team on 01621 841233 or 07973 829161, or email enquiries@neilsmithaccountancy.co.uk.