Also known as a P&L, a profit and loss account is an essential tool when running a business and you’d struggle to maintain control of your finances without one. So, how can you build a profit and loss account in the most effective way? Here at Neil Smith Accountancy, we’re here to show you exactly how. If you need further help with your profit and loss account then contact us and we will guide you through it.

What precisely is a profit and loss account?

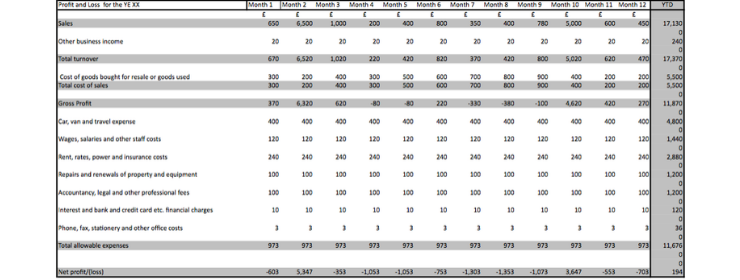

Usually created annually, a P&L account details revenues and costs and how much profit your business has made over a specific period. Along with a cash flow forecast and balance sheet, it forms the basis of all your bookkeeping.

Incorporate it into your business plan

Coming in at about three pages long – your P&L account is the basis of all of your bookkeeping. The first sections should be made up of:

- A monthly two-year forecast of your profit and loss

- A further three years of your profit forecast

- A Cashflow forecast for the next two years

Useful templates for creating your P&L accounts

With both templates adhering to HMRC guidelines, these are a useful tool when creating the P&L accounts for your business. Click here for the PDF version for business earning under £77,000 and click here for business earning over £77,000. For XLS, click here for businesses earning under £77,000 and here for business with an annual turnover of over £77,000.

Sales, sales, sales

All sales income from your business should be added for the period that is being active, regardless as to whether the payment has been received or not.

Should no payment have been received, this should be imputed to the debtors account in your businesses balance sheet.

Sales and their costs

Included in under this financial umbrella are any direct costs included in producing and selling this product: salaries of workers, plus purchases from suppliers for all goods and raw materials used during the accounting period.

Overheads, overheads

Overheads include generic expenses plus all other outgoings you have experienced during this period. Examples of this include utilities, rent, rates, professional fees, costs of running a vehicle and national insurance contributions. Not yet paid but invoiced for will be inputted into your creditors account on your balance sheet.

Every cloud…

With just a reliable internet connection, cloud-based accounting has opened new doors and secures that businesses have a real-time view of their cash flow in new ways. Providing efficient reconciliation of your bank accounts, with this crucial data at your fingertips it’s giving you a clear view of how much cash your business has to dabble with.

To guide you through this fuzzy yet incredibly important world of accounting, Neil Smith Accountancy are close at hand to guide you each and every step of the accountancy journey.

Drop by for a chat with our friendly team at one of our Essex offices, call us on 01376 512 637 or 07973 829 161, or send an email to enquiries@neilsmithaccountancy.co.uk. Alternatively, get in touch via our contact page.