The Coronavirus Job Retention Scheme (CJRS) has been a leading measure in the government’s financial support package for businesses. Introduced at the height of the Covid-19 pandemic in March 2020, the CJRS has offered a vital lifeline to businesses who were being made to close and would not have been able to continue paying their staff. In the ever-evolving pandemic landscape, UK chancellor Rishi Sunak has announced that CJRS will be around for a while longer than originally planned.

Coronavirus Job Retention Scheme

HMRC’s CJRS enabled employers to claim 80% of an employee’s wages (to a maximum of £2500 per month) in instances where they were not working but remained on the company’s books. For all ‘non-essential’ businesses that were forced to close during lockdowns and as a result of the tier system restrictions, the scheme has enabled their workers to remain in employment with a secure income. Since its inception there have been over 9.5million jobs furloughed by over 1.2million different employers. This has lifted a significant financial burden off of the shoulders of businesses who are struggling under closures, restricted footfall, and the costs of becoming Covid-secure.

Job Retention Bonus Scrapped

A Job Retention Bonus had been announced, to allay fears of people abusing the CJRS and to provide job security for people once furlough ended. It planned to provide a one-time grant of £1000 per furloughed employee if they were still on the company’s books at the end of January 2021. This was also dependent on employees receiving a total of at least £1560 in wages for the period 6th November 2020 to 5th February 2021. This is an average of £520 for each of the three months. However, with fluctuating infection rates and the need to reintroduce restrictions across the country, the bonus has been scrapped in favour of extending CJRS. The government has said that a retention incentive will be redeployed when appropriate. Details of the date and requirements have not yet been announced.

CJRS Extended Until March 2021

As it stands, the CJRS will now be in place until the end of March 2021. The previously planned Job Support Scheme is now null and void, as the continuation of the CJRS supersedes the scheme. The extension is intended to provide security over the winter months and allow businesses some more time to recover from the effects of the various restrictions in place. The details of the extended policy are reminiscent of the previous two forms, however there have been a few changes.

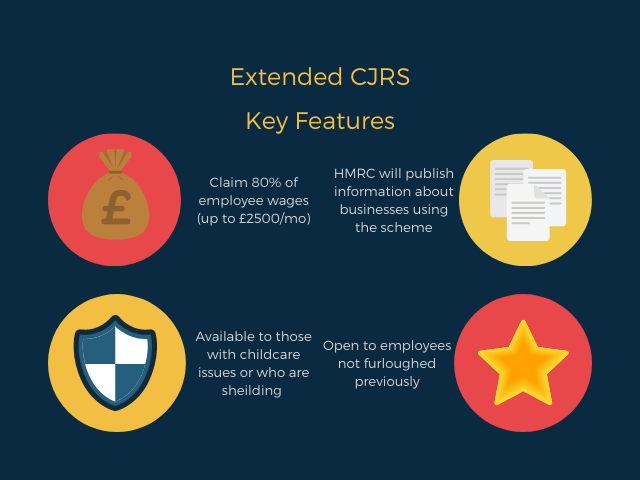

Extended CJRS Key Features:

- The scheme is effectively resuming the level of support offered throughout March to August this year. The entitlement stands at 80% of employee wages (capped at £2500 per month).

- Employees can work part time, with the CJRS covering 80% of the usual wage for the hours that are unworked due to Covid.

- Furlough can cover employees who have childcare issues due to the pandemic or who are required to shield.

- The scheme is now open to employees regardless of whether or not they have been furloughed before.

- There is no limit to the number of employees that can be furloughed under this version of the scheme.

- There will be documents published by HMRC to show which employers are utilising the scheme from December onwards. This will enable employees to check whether or not their employer has claimed under the CJRS and should help to reduce fraudulent claims.

- To be eligible, employees must be on the company payroll at some point between 20th March and 30th October 2020.

- All employees are eligible, regardless of contract or position.

- Employers must submit claims for November by 14th December.

The 80% of employee wages entitlement runs to January 31st, at which time the government will review the policy, making a decision based on economic circumstances as to employer contributions.

Neil Smith Accountancy have been providing accounting services to small businesses in and around Essex for thirteen years, in addition to Neil’s over eleven years experience prior to setting up. This experience helps the company be perfectly placed to offer services and business advice at this difficult time. Get in touch via the website, email enquiries@neilsmithaccountancy.co.uk, or call 01621 841 233 / 01376 512 637 / 07973 829 161.