Since publication of this blogpost, the Coronavirus Job Support Scheme has been scrapped, in favour of extending the Coronavirus Job Retention Scheme, which will now run until March 2021.

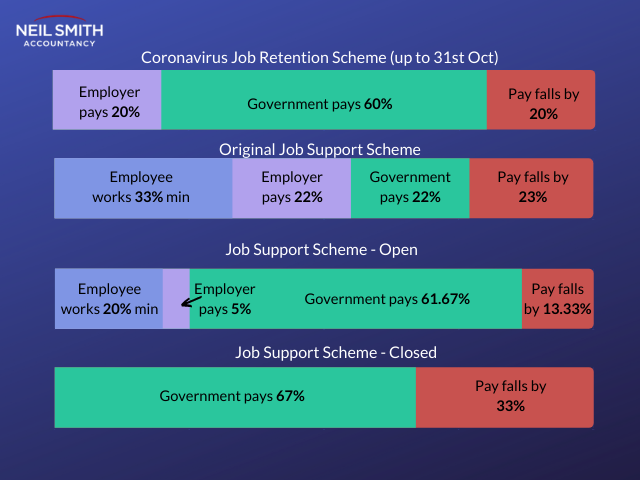

The government announced The Job Support scheme on 24th September. The intention is to protect viable jobs and support businesses suffering a downturn due to the conditions imposed because of Coronavirus. The scheme is set to begin on 1st November, once the Coronavirus Job Retention Scheme has ended. It is scheduled to run for six months, with a review of its terms in January. Qualifying employees had to work a minimum of one third (33%) of their usual hours. The government and employer would then contribute 22% each of the deficit, ensuring 77% of each person’s wage was paid.

Job Support Scheme updated 9th October

The Job Support Scheme has since been expanded to include support for companies which have closed due to the virus. If you’ve had to close your premises as a result of the Covid-19 restrictions, the government will pay two thirds of each employee’s salary. There is no obligation for the employer to make up the remaining amount. They are responsible for paying NICs and pension contributions, however it is estimated that about 50% of the claims expected will not incur these, so there will be nothing for the employer to cover. This support will still be available from November for six months, with a review scheduled in January. Businesses are eligible to claim the grant only whilst they are closed due to restrictions, and for employees who miss work for at least seven consecutive days.

Job Support Scheme updated 22nd October

There have been further changes to the Job Support Scheme on 22nd October, involving a restructure of the support offered. It has now been split into JSS Open and JSS Closed, offering different support based on the needs of the business. An organisation can make claims under both the Closed and Open schemes at the same time for different employees. Each member of staff is only eligible for one scheme at a time.

JSS Open

The Job Support Scheme Open is designed for companies experiencing decreased demand, but still able to safely operate. JSS Open allows employers to retain vital staff on reduced hours, providing a higher level of support than initially promised. The government hopes that more jobs will be protected thanks to these increased grants.

Rather than a third as per the previous version, employees must work at least one fifth (20%) of their usual hours to qualify. This will be paid by the employer in the standard way. In addition, workers will receive a percentage of their normal wage. 5% will be paid by the employer, who may also pay more if they would like to. 61.67% of the usual wage will be covered by the government, up to £1542.75 per month maximum. Staff will still receive at least 73% of the wage they are accustomed to, where they earn up to £3125/month.

JSS Closed

Many employers have found they are legally obliged to close due to the Covid-19 restrictions in place. JSS Closed has been set up to help businesses save jobs which might otherwise be lost during these difficult times. Each employee will receive two thirds of their normal monthly pay from their employer, who will then claim the full amount back from the government. It is at the discretion of the company to make payment for some or all of the shortfall.

This measure will ensure income for team members who are unable to work, which was not provisioned for under the original scheme. It offers protection for jobs which would not be viable throughout prolonged closure, allowing organisations to reopen speedily when conditions permit.

Further guidance for both schemes will be made available at the end of October 2020.

For assistance navigating the financial waters at this difficult time, why not get in touch with Neil Smith Accountancy? The professional team will be happy to take the burden of accounting off of your shoulders and offer helpful advice to maximise your small business’s potential.